This morning I had two of my larger holdings, Starbucks and Twitter, become embroiled in headlines. It was announced this morning that Twitter has a new shareholder, Elon Musk, and that Starbucks would be axing their $20B buyback program as Howard Schultz looks to make a stamp on his welcoming party.

Whilst I am in the middle of writing some other reports, I felt compelled to share some insights and commentary on both of these events this morning, given that they are timely.

Twitter & Their New Shareholder

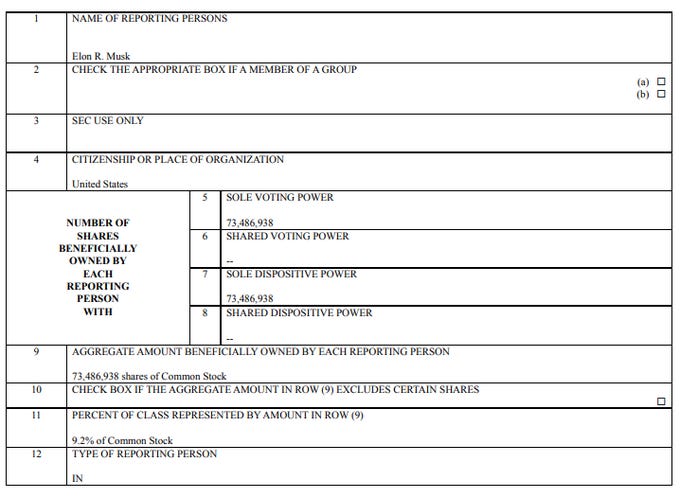

Shares of Twitter were trading as high as +26% in the early pre-market hours this morning, after an SEC filing from Twitter shows that Elon Musk, founder and current CEO of Tesla has acquired a "passive" but sizeable 9.2% ownership stake of Twitter (~73.5M shares).

This comes after Musk tweeted a poll a few weeks back asking if Twitter adheres to the principle of free speech, warning voters that "the consequences of this poll will be important".